How to Calculate Fill Rate & OTIF Metrics to Improve Business

How do we measure fill rate? How do we measure OTIF (on-time, in-full)? How can we use these metrics to improve business performance?

Fill rates and OTIF (on-time, in-full) metrics can be used to measure the level of customer satisfaction from an order fulfilment point of view.

There are multiple ways to calculate these metrics depending on which point of view you’re trying to measure and the level at which data is stored in your computer system. I’ll explain what that means as we progress through this blog.

Definition of Fill Rate

Fill rate is a metric which calculates the percentage of customer orders that a company successfully ships. For example, suppose you have 10 customers and they each order 5 bottles of hand lotion from your web site. You happen to have 57 bottles of this particular hand lotion in stock and you ship 5 of them to each of these 10 customers.

The order fill rate is:

Learn about inventory management or take this course as a refresher on the basics.

10 orders shipped complete / a total of 10 orders

or 100%

Now suppose customer #11 comes along and orders 9 bottles of this lotion. You have 7 left in stock after fulfilling the orders of the first 10 customers. You ship those 7 to Customer #11 and the remaining 2 bottles are placed on the back-order list to show that you still owe that customer 2 bottles of lotion in order to complete their order.

The order fill rate is now:

10 orders shipped complete / a total of 11 orders

or 90.9%

Fill Rate is Measured Over a Specific Period of Time

A company may choose to calculate its fill rate monthly, quarterly or yearly. With data being so readily available, I’ve also monitored fill rates on a daily basis. This is possible as long as your data set doesn’t become so large that it slows down the tool you use to view the metric.

In the dashboard image above, I have daily fill rates showing in the larger charts and I have YTD (year-to-date) fill rate summaries in the dials on the right.

Order Fill Rate vs. Volume Fill Rate

You may notice that I have two different fill rate definitions showing on the dashboard. This company sells its products in both single units and cases. For the order fill rate shown in grey, whether the customer ordered 1 unit or 1 case, their order counts as one data point in calculating the fill rate.

Suppose:

Customer A orders 1 bottle of shampoo and

Customer B orders a case of 12 bottles of shampoo.

Each of these customers counts as 1 order and we calculate the fill rate as we did previously, namely,

Fill rate = # of orders shipped complete / total # of orders

The red chart is showing a volume fill rate. For this fill rate, it matters whether the customer ordered a single unit or a case.

Suppose:

Customer A orders 1 bottle of shampoo and

Customer B orders a case of 12 bottles of shampoo.

You happen to have 6 bottles in stock. You send a bottle to Customer A and you choose to ship nothing to Customer B until you have a full case ready to ship. In total, you shipped 1 unit out of a total of 13 units requested.

The volume fill rate in this case is:

volume shipped complete / total ordered volume

= 1 / 13 or 7.7%.

For Customer B, if you decided to send them the remaining 5 bottles you had in stock instead of waiting for a full case to be available, your volume fill rate would be:

Fill rate = 6 units shipped / 13 units requested

or 46.2%

Which Fill Rate Should I Choose?

You may be wondering which fill rate to measure and why I have measured both for this company. The order fill rate is really a measure of the percentage of customers you please over time, so it is a metric from a customer point of view.

The volume fill rate is really a measurement of how close you came to shipping complete orders. It is sometime easier to interpret this metric by looking at how far from perfect you were. Did you miss filling the order by a few units or several cases? This metric is useful from an internal inventory planning point of view. How well did you match your in-stock inventory to customer demand?

Let’s take a closer look at the charts on the dashboard and see what they tell us about this company. YTD, this company has an order fill rate of about 92%. They disappoint customers approximately 8% of the time. The dark line at 98% is the goal they would like to reach this year.

Their volume fill rate is substantially lower. This indicates that they do have orders where they missed filling the entire volume by cases rather than units. This provides an indication that there is room for improvement in planning for customer demand.

If we look at the daily order fill rate chart shown in grey, we can see a few days in September where the company filled only 40% of orders. The next few months show higher fill rates, mostly in the range of 75-100%. This indicates that up to 25% of customer orders weren’t shipped in full.

For additional information, let’s look at the daily volume fill rate shown in red. This chart shows a more widely fluctuating fill rate which provides an indication of how far off the inventory was during this time period. The larger the drop, the more we know that the order shipments were off by cases rather than single units. This company is located in the USA and most of the volatility in this metric aligns with the peak retail season including American Thanksgiving, Christmas and New Year retail sales. This is the high season for customer demand.

Why Don’t Companies Aim for a 100% Fill Rate?

I mentioned that this company has a target fill rate of 98%. You may wonder why they don’t target a fill rate of 100%.

100% is great for customer satisfaction but it is usually indicative of having surplus inventory. If you’ve watched any of my YouTube videos or read my other blogs, you may recall me saying that inventory is cash tied up that a company can’t use for something else. The inventory goal of a company is to have enough of the right items in stock to meet customer demand while minimizing the amount of money tied up in inventory. That means that a lot of surplus inventory would hinder a company’s cash flow.

On average, companies have a fill rate in the range of 85-95%. Top-performing companies manage 98-99%. Of course, the more items and variants of those items that you offer, the harder it is to stock the right amounts of everything.

The Impact on Your Calculation of How Data is Stored

The final comment I’ll make about fill rates is that sometimes performing this calculation at the order level is impractical depending on how order data is stored. For example, if your data system doesn’t allow you to easily consolidate measurements of all line items together, you can calculate the order fill rate at the line item level. In this case, the fill rate is really measuring the percentage of line items shipped in full.

When orders tend to combine a variety of product units of measure, the line item approach can be an alternative approach for the fill rate calculation. Which calculation level you choose for fill rate is less important than monitoring the changes of this metric over time and determining the root cause of decreases in your fill rate.

In an effort to get to the root cause of fill rate issues, further segmentation of this metric is useful. For example, you can segment your fill rates by customer to see if certain customers are being repeatedly disappointed. You can segment your fill rate by sales channel to see if one channel is causing most of your issues. You segment your fill rate by product to see if a certain product or product line is your main issue.

Definition of OTIF (On-time, in full)

The last metric I’ll discuss is OTIF or on-time, in full. This metric measures the ability to:

Deliver the expected product to the customer (the correct product),

Deliver the quantity ordered,

Deliver to the customer’s desired location, and

Deliver it by the customer’s expected date.

While the fill rate measures the ability to fill orders, this metric includes additional factors which include order accuracy and timing. While filling a customer order, it is possible to send an order in full, but you may have sent it several days late or shipped the wrong product. The OTIF takes additional customer satisfaction factors into account.

The supply chain industry has not settled on an exact formula for the OTIF, but in general, the formula is:

The number of deliveries made on time and complete / the total number of deliveries.

In many cases, such as the company data I have shown here, the company does not operate based on delivery dates but rather on shipping dates. In this case, we base our OTIF metric on the customer’s desired ship date and we compare that to the order’s actual ship date.

Other Business Considerations Impacting Calculations

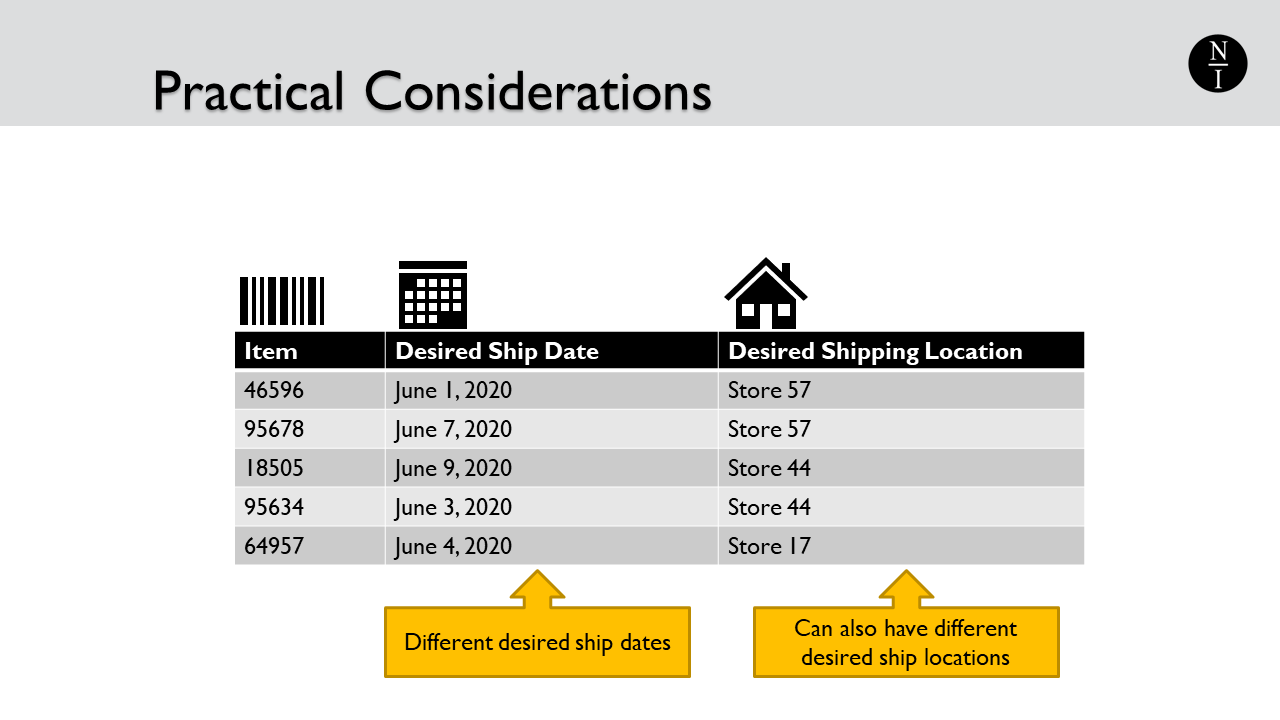

Another practical consideration is that a customer may order several different items and want them shipped on different dates. In this case, the entire order doesn’t have the same dates associated with it, so, like the fill rate, it is often more practical to calculate the OTIF at the line item level rather than the order level.

Also like many metrics, it’s often far more useful to see how a metric trends over time to see if business operations are improving or declining rather than focussing on the specific value of the metric. This is one of the reasons that I create both daily charts and YTD views of fill rates and the OTIF metric. The values you choose for your target levels will depend on your product offerings and the current performance levels of your business operations.

In Summary

Fill rates and OTIF metrics can tell you a great deal about the performance of business operations. While viewed as inventory metrics, their application extends beyond inventory into the areas of customer satisfaction and production. Skillful segmentation of these metrics can provide valuable insights into operational issues and can be beneficial in determining the root cause of performance issues.